Last week we covered important information about student loans – some statistics, what types of loans there are, and some steps to take before going into default. If you didn’t read that article you can read it here: http://www.mufinancialtip.blogspot.com/. This week we will discuss default rates and some steps you can take to prevent student loan problems.

STUDENT LOAN DEFAULT RATES

If you do enter default, you should still try to utilize one of the methods discussed last week, including forbearance and getting a more flexible repayment plan. If you are in default here are some actions the federal government can take:

- Deny new student loans

- Report the delinquency on your credit report

- Intercept tax refunds

- Garnish your wages without a court order

- Hire aggressive collectors

- Charge high collection fees – as much as 25% of the total loan balance

- Professional license revocation

In addition, there is no statute of limitations on federal student loans, which means they can attempt to collect on your loans indefinitely.

Earlier in September the U.S. Department of Education released the official FY 2009 national student loan default rate[i] – which is now at 8.8%, up from 7.0% in FY 2008.

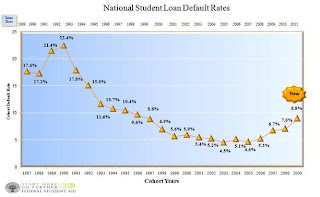

Here is a graph of the national student loan default rates for the past 25 years[ii]:

As you can see from the chart the default rate is substantially lower than it was in the late 80’s and early 90’s, before some reforms in government lending. Unfortunately, after many years of declining default rates, the trend is again going up.

Here is a chart comparing Missouri, and specifically the University of Missouri (Columbia campus only) with the national rates, for the past 3 years[iii]:

2009 | 2008 | 2007 | |

National rates | 8.8% | 7.0% | 6.7% |

State of Missouri | 7.6% | 5.8% | 6.0% |

University of Missouri | 2.9% | 2.3% | 2.4% |

PREVENTING STUDENT LOAN PROBLEMS

There are steps I recommend you take while in school to try to minimize your student loans, which will help you have a lower payment after graduation:

- Don’t use student loans to finance an unaffordable lifestyle – live like a student now so you won’t have to continue to live like one after school.

- Don’t just accept the full amount of loans offered to you if you don’t need it. Review your budget and take the minimum amount you can.

- Don’t use student loans to purchase all the newest electronic gadgets. I know, the iPads and latest iPhones and everything else with an “i” in front of it are really cool, but do you really need all of them while you are a student? If you haven’t had to distinguish between needs and wants before college, there is no better time to do so than now.

- Consider working part-time. Some people won’t agree with me on this, but I think it is OK for students to work part-time while going to school to help pay for housing, food and other living expenses. Students who work part-time gain valuable time management skills as well as resume building experience. School needs to come first, though – if your grades are suffering you need to re-evaluate how many hours you are working.

- While I haven’t talked about private student loans much in these articles, private loans are always going to be more expensive than Direct loans. Maximize your Direct loans before taking out any private loans.

- Keep your grades up and apply for every scholarship you qualify (or might qualify) for.

Ryan H. Law, M.S., AFC

Personal Financial Planning Department

Office for Financial Success Director

University of Missouri Center on Economic Education Director

239E Stanley Hall

University of Missouri

Columbia, MO 65211

573.882.9211 (office)

573.884.8389 (fax)

[iii] You can find State-by-State default rates for the past 3 years here:

2007: http://www2.ed.gov/offices/OSFAP/defaultmanagement/2007staterates.pdf

2008: http://www2.ed.gov/offices/OSFAP/defaultmanagement/2008staterates.pdf

2009: http://www2.ed.gov/offices/OSFAP/defaultmanagement/2009staterates.pdf

and rates for each educational institution here:

http://www2.ed.gov/offices/OSFAP/defaultmanagement/cdr.html

1 comment:

Although I don't condone students to get loans, I do agree that the best student loans are direct and not private.

Post a Comment